If you prefer that we do not use this information, you may opt out of online behavioral advertising.

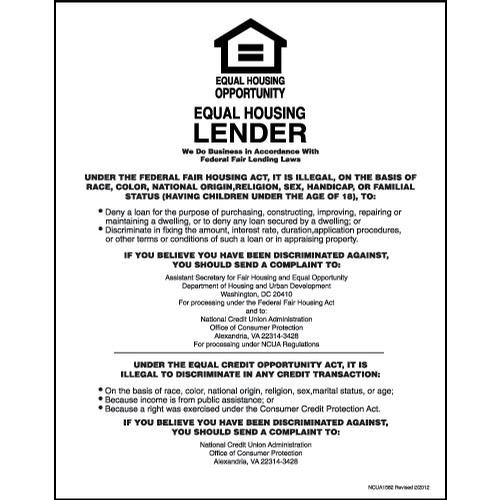

BANK OF AMERICA EQUAL HOUSING LENDER OFFLINE

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Relationship-based ads and online behavioral advertising help us do that. We strive to provide you with information about products and services you might find interesting and useful. Equal Housing Lender © 2022 Bank of America Corporation. Programs, rates, terms and conditions are subject to change without notice. No matter what large expenses you may face in the future, a home equity line of credit from Bank of America could help you achieve your life priorities.Ĭredit and collateral are subject to approval. If a HELOC sounds right for you, get started today by giving us a call, visiting a financial center, or applying online at /HomeEquity.Īnd be sure to inquire about all the ways we can assist you with rate discounts. You'll typically have 20 years for this repayment stage. Once that borrowing period ends, you'll continue to pay principal and interest on what you borrowed. Continue to use your home equity line of credit as needed for the duration of your borrowing period, usually 10 years. So you can take advantage of fixed monthly payments and protect yourself from rising interest rates. Most HELOCs have a variable rate, which means the interest rate can change over time based on the Wall Street Journal Prime Rate.Īnd Bank of America offers you the option to convert $5,000 or more of your balance to a fixed rate, Please consult your tax advisor regarding interest deductibility as tax rules may have changed. The interest rate is often lower than other forms of credit, and the interest you pay may be tax deductible, but you should consult a tax advisor. Plus, Bank of America offers rate discounts when you sign up for automatic payments,Īs well as discounts based on the funds you initially use when opening the HELOC.Īnd there's Preferred Rewards, which extends benefits to you as your qualifying Bank of America balances grow. With a Bank of America HELOC, there are no closing costs, no application fees, no annual fees, and no fees to use the funds. Much like a credit card, a HELOC is a revolving credit line that you pay down, and you only pay interest on the portion of the line you use. If you still owe $120,000 on your mortgage, you'll subtract that, leaving you with the maximum home equity line of credit you could receive as $50,000. Through Bank of America, you can generally borrow up to 85% of the value of your home minus the amount you still owe.įor example, say your home's appraised value is $200,000. Your home's equity is the difference between the appraised value of your home and your current mortgage balance. A HELOC is a line of credit borrowed against the available equity of your home. At Bank of America®, we want to help you understand how you might put a HELOC to work for you. See important information on this web page.Ī home equity line of credit, or HELOC, could help you achieve your life priorities. In life, you often face major home improvement projects, unexpected costs, education expenses,

0 kommentar(er)

0 kommentar(er)